n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

(Bloomberg) — A resurgent speech by Chinese President Xi Jinping suggests authorities may just begin trading government bonds to trade liquidity, pushing the country toward methods used through the Federal Reserve and other primary central banks around the world.

Most on Bloomberg

Trump’s Net Worth Drops $1 Billion as Social Media Company Tanks

A Million Simulations, A Verdict for the U. S. Economy: The Danger of Coming Debt

Erdogan suffers defeat in Turkey’s municipal elections

Trump Media’s Business Doesn’t Matter

Cost of Caribbean Golden Passport rises to $200,000 after EU crackdown

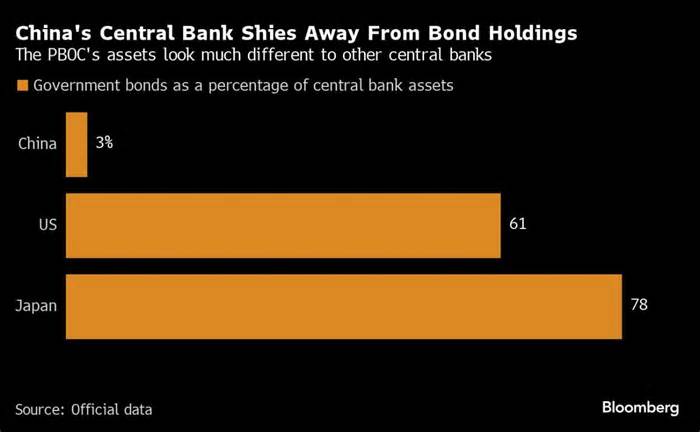

Xi’s call for the People’s Bank of China to “gradually increase the purchase and promotion of government bonds” as part of its open market operations sparked a speculative frenzy among investors last week. The comments — made in October but published recently in a new e-book and newspaper article — may be a sign of a policy shift for a central bank that hasn’t made giant bond purchases since 2007.

“Central banks in other countries use government bonds, or sovereign credit, as a basis for issuing money,” said Liu Lei, a researcher at the National Finance and Development Institution, a state-run think tank that advises government agencies in China. “It’s a mandatory path for China’s central bank and financial formula to enter fashionable times. “

The Chinese leader’s vague comments led some investors to speculate in the first place that Beijing might be contemplating quantitative easing, an unconventional form of stimulus that involves buying sovereign bonds and other assets to lower yields and stimulate economic activity. This tactic was subsequently used through the Federal Reserve and other authorities after the global currency crisis and the coronavirus pandemic.

China’s economic woes have sparked a debate in recent months over whether the world’s second-largest economy would adopt drastic policies to help certain sectors, such as real estate. In the past, the People’s Bank of China has resorted to targeted lending schemes that some analysts compare to QE, as they expand the central bank’s balance sheet.

A number of economists have been reluctant to interpret Xi’s call to trade bonds as a revolutionary policy shift.

On the one hand, Xi in particular talked about purchases and promotions, a notable difference from QE, which commonly involves buying and holding government bonds and other assets, especially on a giant scale. Interest rates in China are also still well above zero, which gives the People’s Bank of China no explanation for a tactic that is sometimes seen as an emergency tool to spice up lawsuits when short-term rates stagnate.

The People’s Bank of China did not respond to a faxed request for comment by Bloomberg News last week about Xi’s speech. In the past, it has expressed disapproval of QE, with former governors pointing to the potential dangers of U. S. -LED QE and warning that asset purchases would damage markets, damage the reputation of central banks, and create “moral hazards. “

On the other hand, the trading of sovereign bonds can be seen as one more tool for the People’s Bank of China to inject liquidity into the market and rate stability.

The central bank already has several tactics to supply cash to the economy. You can inject budget through your medium-term monthly line of credit to promote bank lending or reduce the amount of liquidity banks will have to hold in reserve.

However, there are disadvantages to those methods. Economists say the scope for additional discounts in the reserve requirement ratio is shrinking. Loans will have to be renewed. And any misassessment of liquidity carries dangers that lead to a serious money flow crisis.

The People’s Bank of China “needs more flexibility in liquidity control and more equipment to expand its balance sheet,” UBS Group AG economists Nina Zhang and Wang Tao wrote in a note on Thursday. Bank bond swaps are “more mandatory and feasible,” they added.

While the directive from China’s chief executive indicates that the central bank could start buying bonds, the actual timing of any purchase is still up for debate.

The central bank’s purchase of bonds is most likely a “very slow process,” said the NIFD’s Liu, adding that the replacement is still in its “design phase. “

Others recommend that the upcoming fiscal stimulus may simply mean that the People’s Bank of China will withdraw the cause of purchases later this year. That would ease liquidity strain due to an upcoming build-up of bond sources as a result of the planned issuance of 1 trillion yuan ($138). billion) of special sovereign debt by 2024, according to a report by economists at Goldman Sachs Group Inc. published on Thursday.

It is also unclear what effect the intensification of bond purchases would have on Chinese yields. They will most likely fall in the near term, according to Philip Yin, a strategist at Citigroup Inc. , as the central bank’s purchases of debt securities “should help improve market confidence in liquidity and digest long-term sources of government bonds. “

Long-term effects can be mixed. If China combines the use of more liquidity equipment with new policies to stabilize economic growth, investors would likely shift from safe-haven assets to riskier assets.

Whatever China’s strategy, there’s an explanation why Xi’s comments have created such a stir: As soon as a central bank makes the decision to start trading government bonds, things can temporarily snowball.

The Bank of Japan, for example, intended to narrow the scope of its initial program in 2001 before extending the duration of its bond purchases. When they embarked on a second quantitative easing circular in 2013, the Japanese authorities incorporated their same old bond-trading program. , called Rinban, in its grand plan to buy new assets.

In other words, there is little genuine difference between buying bonds as a liquidity tool and doing so to stimulate the economy.

Most read Bloomberg Businessweek

The Wirecutter Warning and the Internet’s Favorite Wok

How Michael Rubin Slashed All the Cards

Affirmative Action Prohibited on Building Diversity

FTX’s Original Sin Is a Warning to All Cryptocurrencies

Eclipse Boom Cities Bid Their Time in the Sun (Stuck)

©2024 Bloomberg L. P.