The Internal Revenue Service wants to innovate in the fitness and protection of workers working in an underground log shop, where the hazards are falling rocks and damaged ladders.

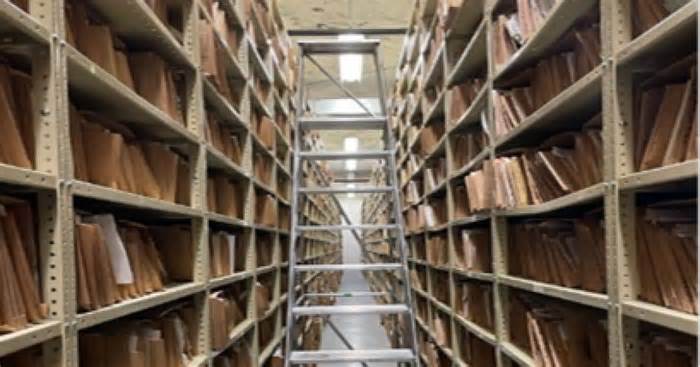

The so-called “Site C,” located in Independence, Missouri, has been the subject of court cases by IRS workers and their union, according to a report released last week through the Treasury’s inspector general of tax administration. In August 2022, the President of the National Treasury Employees Union sent a letter analyzing the fitness and protection issues in the Site C court cases. The NTEU court cases included stones and debris falling on cars parked outside, ladders damaged, unacceptable air quality and fire hazards. In response, the IRS temporarily closed the site. C. TIGTA conducted an assessment to assess the facility’s operations, adding to the IRS’s efforts to respond to fitness and safety issues reported by workers running there.

Site C focuses primarily on the bureaucracy of retail outlets, such as the U. S. Form 709, Income Tax Return for Gifts (and Generational Omissions)U. S. Forms 2848, Power of Attorney and Declaration of Representative, and Forms 8821, Authorization for Tax Information. Employees are guilty of filling in the bureaucracy and selling them to other IRS employees who might need them to complete exams, collections, and assignments. However, all staff are vulnerable to it.

“Unless the IRS addresses known issues, the IRS exposes your C-Site to non-mandatory security risks,” the report says. “In addition, those considerations may slow down the retrieval of mandated tax forms, thereby delaying the IRS’s ability to bring its tax management functions to light. “

The report notes that repeated concerns have been raised about potential damage to cars due to debris and rocks falling from the roof in the area where Site C workers park their cars. Employees told TIGTA that this actually happened. a net formula to pick up debris, but estimated it would cost about $1 million. However, TIGTA inspectors discovered that other corporations had installed plastic sheeting to protect their employees’ cars and advised that the IRS install a similar roof protection net over the parking lot.

TIGTA’s report shows that immediate action will need to be taken through the IRS to address worker protection and fitness considerations at Site C. This includes eliminating unnecessary storage of tax documents that can be deleted, as well as submitting and storing Forms 2848 and 8821 at some other IRS facility. The report also recommends the installation of a walkway to eliminate the use of ladders that do not meet the protection criteria to improve worker protection.

During an on-site inspection of Site C in May, TIGTA identified fitness and protection issues that had not been noticed in the past, specifically with regard to chimney extinguisher training. IRS Facilities Management and Security Services officials have indicated that the Site C worker corps It is not legal to use the chimney extinguishers found at the facility because they have not been trained.

TIGTA’s on-site inspection also revealed some considerations raised through the federal occupational fitness firm and workers running the site, which have not been resolved. Among the considerations, the stairs used at Site C do not meet protection standards. IRS workers also said that requests they have made regarding fitness and protective devices are not being met, adding requests for five devices, a camera in the front of Site C so workers can see who is at the door before allowing them entry. Installation and coating of five in the parking lot. much to private vehicles due to rocks falling from the roof.

IRS officials claimed that a camera had been installed to allow workers to monitor who was at the door. However, TIGTA pointed out that the two cameras installed were within the status quo and not outside the door.

Not only that, but the lease on Site C expires in October 2024 and the IRS still doesn’t have a transparent plan on your long-term options, whether it’s extending the lease, securing some other construction where you can buy the existing and long-term asset forms, or scanning and scanning documents.

TIGTA made 18 recommendations in the report, suggesting that the IRS expand processing procedures to purge documents in a timely manner, identify a suitable facility to purchase Forms 2848 and 8821, access garage boxes without the use of ladders, exercise the body of Site C. workers on chimney protection, add the use of chimney extinguishers, ensure that chimney extinguishers are properly placed, take corrective measures to comply with all recommendations of the Federal Occupational Health Agency, respond to the worker protection and fitness requests and compare the features that can and should be taken to meet the upcoming expiration of the Site C lease.

The IRS has accepted TIGTA’s recommendations and plans to take steps to fix the issues. “Our painters are our most valuable resource, and addressing valid concerns raised through TIGTA, our painters, and NTEU will help us provide our staff with a safer experience. “The IRS started Site C in 2004 and is one of several tenants of this man-made cave complex. “

He added that FMSS has ordered new ladders, but agreed in principle that employees should be able to access the stored boxes of paper files without ladders. The IRS is pursuing options such as relocating forms to lower shelves and other storage areas that employees can access without having to climb tall ladders. The IRS is also commissioning a feasibility study to look into installing raised catwalks.

Today’s Annual Accounting on the idea leaders and change agents who shape the career and its refreshments.

The most influential people in the field, selected through their peers.

According to a new report, many academics don’t have the monetary resources to pay the tuition and fees needed for a certified public accountant.

The Internal Revenue Service needs to make improvements to protect the health and safety of employees working at an underground file storage site, where the perils include falling rocks and broken ladders.

The Internal Revenue Service and Treasury plan to propose regulations on a requirement for a product identification number, and they’re asking for comments ahead of time on the PIN requirement.

The ERP software and IT consulting provider adds expertise in Sage 100, Sage 50 and Sage BusinessWorks.

We asked many humans what they think about AI.

Additionally, the FAF appoints members of the Advisory Council on Government Accounting Standards; PCAOB names next IOC; and more news from the profession.

Today’s annual survey of companies’ expectations, concerns, and plans for the next 12 months.

Accounting Today is a leading provider of online business news for the accounting community, offering breaking news, in-depth features, and a host of resources and services.