n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

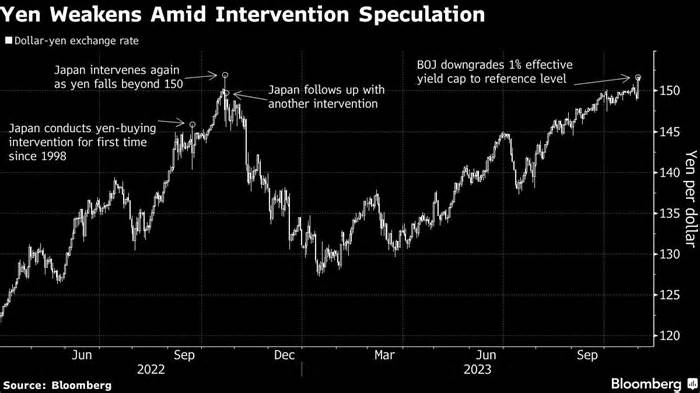

(Bloomberg) — Contradictions in Japan’s efforts to protect the yen while slowing the speed of emerging market bond yields are proving evident in currency and debt markets.

Most on Bloomberg

Immigrants Leave Canada at a Faster Rate, Finds

Israel: Biden calls for a “pause” for hostages to enter Gaza

The real estate sector is affected by the ruling on commissions

Powell hints that the Fed is done with market-hailed pivot hikes

Stocks Rise as Fed Rate Hikes Near End: Markets Retreat

While Thursday paints another picture after the Federal Reserve kept rates unchanged, Tokyo’s action on Wednesday underscores the enormous challenge facing Japan.

The day began with the Finance Ministry’s most sensible foreign exchange official issuing one of the harshest warnings yet, stating that the government was in a position to interfere in the foreign exchange market to stem the yen’s slide. At lunchtime, the Bank of Japan is preparing to interfere in the debt market to slow the speed of the rise in the 10-year bond yield to 1%.

The Bank of Japan’s unscheduled bond purchases were shocking: They came just 24 hours after the central bank dumped its 1% cap on yields. The deal also directly thwarted efforts to prop up the yen, which is weighed down by the wide spread between interest rates in Japan and the United States.

The result for the coin was a 0. 5% advance on Wednesday and a further 0. 2% gain so far on Thursday. That has taken it away from 151 points against the dollar, but it remains in sight if its 33-year low reached last year. year. Still, the yield on the 10-year note rose on the day and was just 1. 5 fundamental issues below the new decade high it had set before the central bank announced its acquisition operations. Bond futures point to a decline in yields on Thursday as the long-term earnings scenario remains unchanged, and a 10-year debt auction scheduled for later in the day has investors on edge.

“The moves of the finance ministry and the Bank of Japan are out of sync,” said Tsuyoshi Ueno, senior economist at the NLI Research Institute, who sees the answer to the challenge in its U. S. interest rate cuts and any long-term interest rate cuts. Until then, the government will have to be patient. “

Speculators in both markets are betting that Japanese authorities won’t break even, and the stakes are rising. An exaggerated depreciation of the yen could worsen inflation in Japan, in part by pushing up import prices, while higher yields could simply worsen inflation in Japan. prematurely halting Japan’s recovery.

“We are waiting,” said Masato Kanda, the ministry’s most sensible foreign exchange official, echoing remarks he made a year ago, the day Japan made the first of three forays into the market. “But I can’t say what we’re going to do and when, we’re going to make global judgments, and we’re going to make judgments quickly. “

Read more: Japan urges caution on yen intervention after Bank of Japan’s sell-off

His comments on Wednesday followed the yen’s biggest one-day drop since April on Tuesday after the Bank of Japan’s disappointing replacement of the bond yield ceiling showed that the move away from ultra-loose policy would likely continue to be slow and gradual.

On the other hand, in the Japanese stock market, the Topix index posted its highest level in more than a year due to the tailwind on stocks due to low loan prices and a weak yen.

Even though Japan’s benchmark 10-year yield has doubled since July 27, a day before Governor Kazuo Ueda made his first changes to control the yield curve, it is still about 4 percent lower than its U. S. equivalent.

It turns out that the Bank of Japan needs to moderate its moves, while investors look to raise yields.

“While the BoJ has taken steps to discourage emerging returns, market participants probably need to see the long-term yield reach 1%,” said Keisuke Tsuruta, senior steady source of income strategist at Mitsubishi UFJ Morgan Stanley Securities Co.

He added that the unscheduled takeover this time would possibly have been a precautionary measure ahead of Thursday’s highly anticipated auction of 10-year bonds.

BOJ buys more bonds to curb yield a day after the change

“At the heart of the Bank of Japan’s thinking is its lack of confidence in its ability to achieve sustainable 2% inflation, so it will have to maintain an accommodative financial policy,” said Shusuke Yamada, head of Japan rates and currency strategy at BofA Securities. Inc. ” For the Ministry of Finance, it’s all about looking for volatility and currency exchange levels. Allowing the yen to weaken has its downsides for consumers.

–With those of Yumi Teso and Daisuke Sakai.

(Add prices)

Most read Bloomberg Businessweek

The world’s safest market is a magnet for big investors

The disaster of the Web Summit Israel comes as no surprise to those who know its founder

Why Fewer and Fewer C-Suite Executives Are Taking the Commercial Plane

Foxconn makes your iPhone. Now make your electric car

These countries are key economic “connectors” in a fragmented world

©2023 Bloomberg L. P.