To review this article, My Profile and then view the stored stories.

To review this article, My Profile and then view the stored stories.

Knight

To review this article, My Profile and then view the stored stories.

To review this article, My Profile and then view the stored stories.

Playing

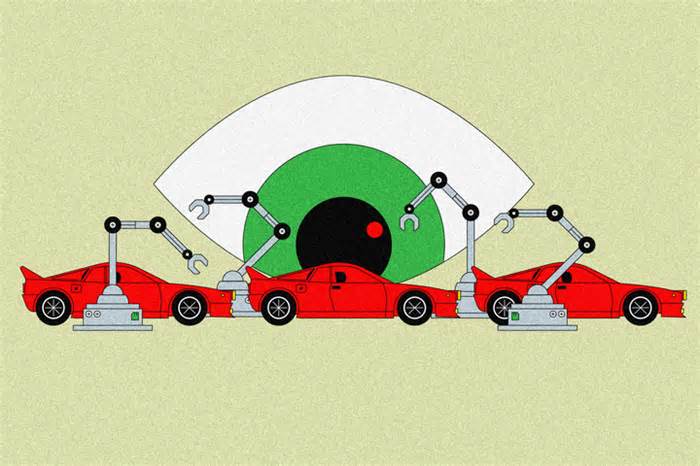

Rumors of a cession of an electric car from Apple have long excited investors and iPhone enthusiasts. Almost a decade after the main points of the transfer were leaked, the Cupertino mobile is still mythical, but that has not stopped other electronic customer corporations from moving forward. Another aspect of the world, other people will soon order a vehicle from the Taiwanese company that dominated Apple’s device manufacturing in China. Welcome to the Foxconn-mobile era.

This content can also be viewed in which it originates.

In October 2021, Hon Hai Technology Group, better known worldwide as Foxconn, announced plans to produce 3 of its own electric cars in collaboration with Yulon, a Taiwanese automaker, under the name Foxtron. Foxconn, which is best known for assembling 70% of iPhones, has similar ambitions for the auto industry: to be the manufacturer of the selection of a new type of logo car. To date, it has signed agreements to make cars for two U. S. -based electric vehicle startups. U. S. , Lordstown Motors and Fisker.

Foxconn’s own cars — a hatchback, a sedan and a bus — don’t ooze apple-chic, but they’re a big step forward for the customer electronics maker. Foxconn’s ambitious expansion plan also reflects a bigger shift in the automotive world, in terms of generation and geography. The United States, Europe and Japan have explained what cars are in the last hundred years. Today, the transformative nature of the automobile, with increased electrification, computerization and autonomy, means that China can increasingly know what car production is.

If Foxconn succeeds in creating a primary car production company, China would become an automotive epicenter capable of dwarfing the traditional powers of the United States, Germany, Japan and South Korea. Foxconn did not respond to interview requests.

The automotive industry is expected to undergo primary transformations in the coming years. An October 2020 mcKinsey report concluded that automakers will believe in new tactics for selling cars and generating profits through subscription apps and services. In some tactics, the long-term car looks a lot like a smartphone on wheels.

In part, that’s why there’s no better time than now for an electronics manufacturer to try car manufacturing, says Marc Sachon, a professor at IESE Business School in Barcelona who studies the automotive industry. with fewer parts and fewer meeting steps. The electric vehicle supply chain is easier to manage than the traditional supply chain, which is one of the core competencies of established automakers. China, Sachon adds, has a strong ecosystem of electric vehicles, from batteries to software for component manufacturing.

China has a unique location to lead the pace toward electrification. The country already boasts some of the world’s most complex battery manufacturers, adding CATL and BYD, the latter of which also produces cars. Automakers in the region can gain merit in terms of understanding and operating new battery technologies just by proximity, in the same way that software corporations get merit from proximity from chip design corporations.

The country is already a hot spot for electric cars, with electric vehicle corporations such as BYD, NIO and Xpeng challenging Tesla’s market-leading position. One of the most popular cars in the country is the Wuling Hongguang Mini EV, a vehicle for two that costs around $5,000. Electric vehicle sales in China have been boosted through government subsidies and outpace all other nations, accounting for 14. 8 percent of Chinese car sales, up 169 percent year-over-year, according to data from the China Passenger Automobile Association, an industry organization. Electric cars accounted for 4. 1% of car sales in the U. S. In the US in 2021 and around 10% in the EU.

Consumer electronics corporations are seeing the automotive sector as their territory due to the increasing computerization and connectivity of fashionable cars. Conventional automakers, who have built their fortunes on the cars they replace shortly after purchase, have been slow to adapt to the new opportunities presented by the software. and connectivity.

Many corporations recognize the opportunity to challenge the prestige quo. In addition to supposedly exploring its own car, Apple is developing complex automotive infotainment software. tech corporations are already designing the cars themselves. In March, Sony announced plans to build electric cars in collaboration with Honda.

But if interest is rising elsewhere, it’s spreading to China. Huawei, Tencent, Alibaba and others have agreements to expand the software and with automakers. Chinese smartphone maker Xiaomi announced last October plans to build another 4 electric vehicles and, according to some reports. Rival Oppo has similar ambitions. Earlier this month, JiDU, a company founded through automaker Geely and studio giant Baidu, unveiled its first vehicle, called the ROBO-1. Baidu has invested heavily in the synthetic intelligence needed for autonomous driving with the support of the Chinese government, some other explanation for why it considers itself a budding automaker.

“The combination of electric cars and autonomous driving creates opportunities for corporations like Foxconn, like Xiaomi, etc. ,” says Gregor Sebastian, an analyst at the Mercator Institute for China Studies, a think tank focused on China-Europe relations.

A study by Sebastian and colleagues published in May concludes that the shift to electric cars could have profound implications for EU and Chinese industry in the coming years, potentially turning the net exporting bloc into a net importer of vehicles. Tesla makes the most electric cars in China for export, but domestic brands are catching up. Shanghai-based NIO would seek to identify production capacity in the United States and Europe. And Foxconn has announced plans to make cars at a giant Ohio plant that was once operated through GM.

At first glance, Foxconn seems to be well placed to enter car manufacturing. But there are significant and demanding situations to overcome.

Foxconn’s expertise is to harness human labor, at incredible cost, to assemble complex devices. This is fundamentally different from the highly automated paints of car manufacturing, and Foxconn has struggled to introduce more robots into its production lines in the past. Electric cars are less difficult to manufacture than traditional cars, with fewer portions needed for assembly, but generating enough cars at a sufficient point is notoriously difficult, with very narrow margins for most automakers.

Mike Juran, chief executive of Altia, a company that makes software to expand graphical user interfaces for cars and other products, also cautions that cars are fundamentally different from smaller devices that don’t want to transport humans at top speeds. Juran highlights the complexity of touchscreen interfaces in some new vehicles. “These are not smartphones on wheels,” he says. These are cars whose generation will have to adapt to the task at hand, which is, in fact, life and death. “

Foxconn’s percentage value appears to be barely supported by its automotive projects, falling just 20% over the past year, in line with the rest of Taiwan’s stock market. of the products it manufactures and creating margins, however, this effort will require significant investments in new production capacities, and may also take years to achieve. Foxconn President Young Liu said the company plans to build a battery supply chain in Kaohsiung, Taiwan. And China’s auto industry is the world’s largest, new vehicle sales fell 11% year-on-year in April 2022, according to the China Passenger Car Association, and few Chinese corporations have been successful overseas.

Car production is a big step forward for Foxconn and other tech corporations because it’s so specialized and challenging, says Bruce Belzowski, managing director of Automotive Futures Group, a consulting firm that has studied China’s auto industry. “In some tactics it makes sense, in others it doesn’t,” he adds. Belzowski suggests that tech corporations to enter car production in China can expect technical breakthroughs that will propel Chinese corporations ahead of their foreign rivals, such as a sharp buildup in battery capacity. But such progress is not guaranteed.

There may not be as many corporations to outsource the manufacture of their cars as smartphone corporations do. On knowledge privacy and market access may also complicate the efforts of Chinese corporations to export cars and build and sell cars in the EU and the US. they think they have to fight an uphill battle,” he says.

However, if Foxconn can make the leap and China becomes a developing force in the auto industry, then the headlines elsewhere will only have to hold on. , just like the plastic and glass rectangles that proliferated at the end of the smartphone boom. And if Apple ends up offering a car, Foxconn might be better placed to make it. If Foxconn can achieve this, established OEMs will have a hard time competing in terms of price,” he says.

Updated on 06/29/2022, 08:00 ET: Kaohsiung is in Taiwan, China. Foxconn’s president is Young Liu, Young Li.

Read more

Read more

? The latest in technology, science and more: get our lyrics!

The Loneliness of the High School Esports Coach

Forget about lasers. The new fashion for physicists is sound

DALL-E Mini is the Internet’s favorite meme machine

How to use Microsoft Word for free

The ghost of Internet Explorer lurks on the web

?️ Explore AI as before with our new database

? Enhance your painting game with our Gear team’s favorite laptops, keyboards, typing, and headphones

More wiring

Contact

© 2022 Condé Nast. All rights reserved. Your use of this site constitutes acceptance of our User Agreement and Privacy Policy and Cookie Statement and your California privacy rights. Wired may earn a portion of sales from products purchased on our site as part of our component partnerships associated with retailers. Curtains on this site may not be reproduced, distributed, transmitted, cached, or otherwise used unless you have the prior written permission of Condé Nast. Choice of ads