Log in to get the most productive news and data about herbal fuel. Follow the topics you need and get the emails.

Germany has revived plans to import liquefied herbal fuel (LNG) into its dependence on Russian herbal fuel, following Russia’s invasion of Ukraine.

Germany’s force strategy of phasing out coal-fired power plants by 2030 and closing its nuclear-power plants until the end of this year has left the country with few to meet the country’s demand for strength.

“The occasions of the past few days and weeks have shown us that a guilty and progressive energy policy is not only very important for our economy and climate, but also very important for our security,” Chancellor Olaf Scholz said in a speech in the German parliament this weekend. The government “will quickly build two LNG terminals, in Brunsbuettel and Wilhelmshaven,” Scholz said.

Three LNG import projects proposed for Germany are in the development stages, adding a floating terminal in Wilhelmshaven, German LNG (GLT) in Brunsbuttel; and the Hanseatic Energy Hub (HEH) in Stade.

The German app Unconsistent with SE had in the past proposed a year-consistent 10 billion cubic meter (Gm3) floating terminal near the German port of Wilhelmshaven, but canceled it last year, opting for the structure of an ammonia terminal. The German government, according to local media, has now asked Unconsistent to review its LNG terminal plans.

“Lately, Uniper is examining the option of resuming plans for an LNG terminal in Wilhelmshaven,” Uniper spokeswoman Linda Patricia Jaram told NGI. floating terminal in recent years. “

Uniper also has the option to further expand its LNG import capacity to the Netherlands before the end of the year, the company said in a statement. In 2021, Uniper had planned to invest in a 1. 0 Gm3/year capacity expansion at the terminal bringing total capacity to 13. 5 Gm3/year until 2024.

A momentary allocation, the 8 Gm3/year GLT terminal in Brunsbuttel, near Hamburg, was initially scheduled to be operational until the end of 2022. But the allocation stalled at the end of 2021, when one of the three partners, Dutch the company Royal Vopak NV, withdrew from the assignment, leaving two partners, the Dutch fuel network operator NV Nederlandse Gasunie and the German Oiltanking GmbH.

Although the previous German government supported the GLT project, no federal investment was committed. But the plans changed.

“The new federal government had already stated in its coalition agreement that diversification of the energy source, as well as long-term energy imports, are necessary. This is exactly the goal of the infrastructure we are planning,” GLT spokeswoman Katja Freitag told NGI.

“Discussions with the German government on the structure are in the final stages,” Gasunie said in an email. “Gasunie expects to begin the structure of the terminal before the end of the year. “

The proposed 12 Gm3/year HEH onshore LNG terminal for Stade in northern Germany is also in a position to make its plans a reality.

“German Chancellor Olaf Scholz has made clear the strategic importance of LNG terminals for the long-term safety of the source in Germany. We are in a position to temporarily build a long-term flexible energy infrastructure with the Stade LNG terminal,” Danielle Stoves, HEH’s lead advertising and regulatory officer, told NGI.

“The preparation of technical plans is complete. All the authorization documents are almost complete and the bidding process for the general contractor has already begun,” Stoves said.

“We make a transparent commitment on the part of the Chancellor to complete our processes quickly,” he said. of April. “

HEH would be a zero-emission allocation with an approved infrastructure for LNG biomethane and artificial methane. HEH partners come with Belgian infrastructure company Fluxys, Swiss personal justice company Partners Group AG and German logistics company Buss Group GmbH.

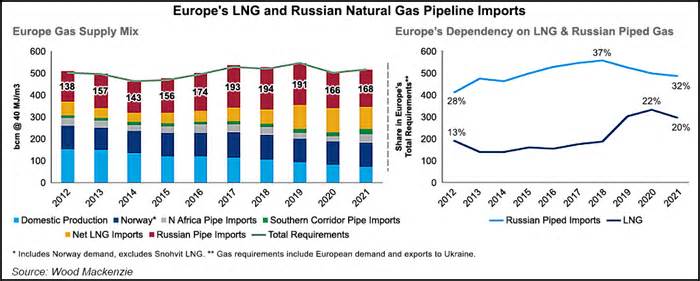

Germany is Europe’s largest fuel customer, but it has refueling services to source LNG. The country imports more than 90% of its fuel through pipelines to meet demand and relies on Russian materials to meet more than 50% of the country’s demand. power call for.

[Want to know what impact on global LNG demand it has on North American fundamentals?To find out, subscribe to LNG Insight. ]

Felix Booth of Vortexa Ltd. , head of LNG, told NGI that even if the terminals can fully upgrade the Russian pipeline in the country’s energy mix, it is possible that they will particularly increase the demand for LNG on the continent over the next five years.

Last week, Germany also halted certification of the 55 bcm/year Nord Stream 2 fuel pipeline, which is complete and in a position to bring more fuel from Russia to Germany. The formula will have to be approved by Germany and the European Union to begin with. Faced with this decision, Germany is temporarily moving to diversify its energy suppliers.

Scholz said the government would expand reserves of herbal fuel by 2 billion m3, to buy in the 23 billion m3 of underground caverns in Germany, which lately are at around 30 percent of their capacity, according to information from Gas Infrastructure Europe.

Under the new law proposed Monday through the Federal Ministry of Economic Affairs and Climate Action, the country would require garage owners to have 65% fuel reserves through August, 80% through October and 90% through December.

It is possible that Germany will extend its coal phase-out deadline to 2030, and make the decision whether or not to extend the useful life of the country’s remaining 3 nuclear power plants. The country would also aggressively expand wind and solar under the proposed legislation.

Download the PDF edition