Even on Good Friday, the day of recovery after five days of sharp declines, shares of the “technological” real estate company, Opendoor, collapsed by 23%, after having collapsed in recent months.

Opendoor Technologies [OPEN] Thursday night reported that the company lost $191 million in the fourth quarter, bringing its 2021 net loss to $662 million, bringing its publicly disclosed 4-year overall loss to $ 1. 5 billion. pinball device loses $1. 5 billion in 4 years? I don’t know too much. But it’s not over yet. The corporate closed the year with a stock of 17,009 unsold homes.

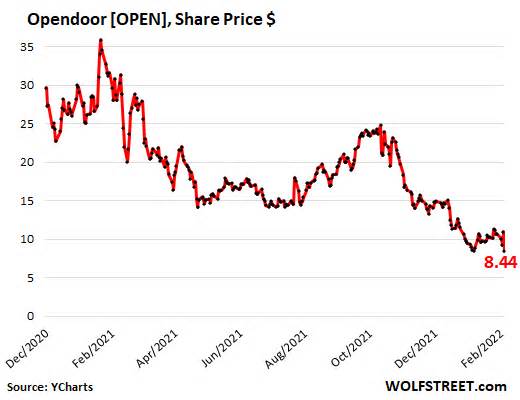

Opendoor went public in December 2020, with an initial public offering of $31. 47 amid great chaos. As of February 2021, inventories are at $39. If “February 2021” sounds familiar, it’s because it’s the month when the inventory market began to sag beneath the surface as peak values began to give way one by one, each according to its own calendar. that started reporting in May 2021. And that’s just another bankruptcy because it’s getting worse. On Friday, the stock closed at $8. 44, down 78% from its February 2021 high and 73% below its IPO price (data via YCharts):

Opendoor reported that it bought 36,908 homes in 2021, but sold just 21,725 homes (for $8 billion) a year, leaving 17,098 homes unsold ($6. 1 billion) in inventory.

Opendoor funded this inventory with $6. 1 billion in “uncontested” debt subsidized through their homes. No recourse means that if Opendoor defaults, lenders get the space and can’t sue Opendoor’s other assets. If Opendoor can’t sell those homes and pay off the debt with the profits, it can cede the houses to lenders and let them worry about promoting the homes.

In addition, Opendor has a contract to acquire another 5411 houses for 1900 million dollars.

Two-thirds of those 17,009 homes are finished and up for resale. About a third (about 5,500 units) are “ongoing” and not for sale. Each of those 17,000 homes that are not being put up for sale, adding up to the 5,500 homes that are still in operation, is in an unknown pile of vacant houses that do not appear in the official “sample” of houses and do not look like vacant houses either.

Zillow did the same with much of its 7,000 homes that were stuck in the pipeline before leaving operations last November and sold those homes primarily to institutional investors, who are now trying to figure out what to do with them. These houses stuck in a fin – The internal projects that are marketed are vacant, but they are not shown as vacant, they are not for sale and are not presented as an “offer”.

Converting space is simple: the first part, buying a space, when cash is not a purpose and you can spend your servers as much as you want. The rest is difficult, and making money is even more difficult, especially if you paid too much in the first place. It turns out that the activity is not suitable for other people who write about algae.

Redfin, who was originally an online real estate broker, also experienced the craze of algorithm-based pinball houses starting in 2020. And his actions [RDFN] The rocket went off amid the endless hustle and bustle of the crazy crowd of cyclists and reached $98. 44 in February. 2021 – yes, in February again.

Then, inventory began a long slump. On Friday they closed at $21. 83, after collapsing 78% in a year. They are now below what they were after the first board day after the IPO in July 2017:

Zillow [ZG] Was given a brief respite from his crisis when he announced on Feb. 10 that he had lost $881 million in 2021 in his home business, which failed in November 2021 when he revealed that he laid off 25 percent of his workers and exited the house in turn business, getting rid of the 7,000 houses he had bought.

He later revealed that he had sold most of those homes to institutional investors, not to other people who might have sought to live there. As long as those vacant homes are not presented for sale, they will not appear in the official “offer”. and many will eventually appear on the rental market. And all this happens while they are mixed, they do not seem so empty either.

The loss of $881 million less than feared and inventory magically recovered over the next 3 trading days, but has since given up some of it. The stock closed Friday at $57. 95, down 73% from their highs a year ago, and about the point they were at in February 2020 before the crash:

Compass, a genuine real estate broker who calls himself a “corporate technology reinvention space,” is one such example, one of many, when you realize something is wrong on Wall Street. upstairs, very bad.

Compass grew by using Softbank and cash from other investors to buy real estate agents across the country. During the five years of publicly released financial statements, Compass lost $1. 44 billion. How can a real estate broker in the real estate market lose $1. 44 billion without a doubt?? It was a rhetorical question.

Compass Arrow [COMP] Peaked on the first day of trading, after its IPO in April last year, at $22. 11 and has fallen ever since. It closed at $7. 65 on Friday, after falling 65% in the 10 months since its first day trading high, and is now 58% below its $18 IPO value consistent with the stock:

Lemonade [LMND], which has been touted as an “insurance generation company” and sells insurance to renters, owners, puppy owners, etc. , went public in July 2020 at $29 consistent with a consistent percentage and the first day of trading, amid great unrest, above 139%. Then it continued to rise until it reached $182 in January 2021. Then it arrived in February 2021, when all that origin collapsed.

On Friday, the stock closed at $23. 48, 83% below its peak and 19% below the IPO price, as the first deal at $50 based on the stock, leading critics of tech stocks to lament how the company “misvalued the IPO” and the amount of cash. “That remains on the table. ” Yes, how far-fetched the offer at the time.

While waiting for the percentage value to collapse, Better. com, a “tech” lending lender, powered by Softbank. It’s not yet a publicly traded stock, as its merger with SPAC was delayed until December 2021 after the CEO laid off 900 employees, most commonly in India, via a viral Zoom meeting, that idiot.

With the merger of PSPC and thus the accumulation of coins, the company raised $750 million from Softbank and its PSPC backers, as those types of corporations are burning gigantic amounts of coins and need a new budget to spend.

So I’m waiting ahead of time when inventory will finally start trading so I can upload it to my list of collapsed real estate technology inventories. That will have to be a smart thing. Let’s hope that the merger with the PSPC will take place.

Do you like to read WOLF STREET and need to? Use ad blockers, I understand perfectly why, but do you want to go to the site?You can make a donation. I really appreciate it. Click on a pitcher of beer and iced tea to receive information on how to:

Would you like to receive an email notification when WOLF STREET publishes a new article?Register here.