“r.itemList.length” “this.config.text.ariaShown”

” this.config.text.ariaClosed “

(Bloomberg) – A two-speed economy looms in Australia and poses a challenge to the central bank, as China’s iron ore order supports the resource-rich West as states grapple with the Covid-19 epidemic and border closure.

The divergent fortunes of the east and west are reminiscent of those created through the mining boom a decade ago and are betting on Australia’s genuine real estate market.

“Our market is in vogue,” said Bev Haymans, a genuine real estate agent in the upscale coastal suburb of Cottesloe, in Western Australia’s state capital, Perth.”There is a genuine sense of positivity.”

Meanwhile, 3,300 kilometers (2,050 miles) east, in Sydney’s coastal suburb of Bronte, Hannan Bouskila is in trouble.Blocking the coronavirus in April is “very difficult” for the real estate market, the veteran 17-year-old real estate industry said, and the new outbreak.in the neighboring state of Victoria has made everyone nervous again.

The divergence poses a challenge for the leader of the Reserve Bank of Australia, Philip Lowe, as he seeks to tackle emerging unemployment and the economy sinking into its first recession in nearly 30 years.

The central bank lowered its benchmark interest rate to an all-time high of 0.25% in March and is expected to keep it on Tuesday for the economy.The next day’s knowledge deserves to show that the country officially entered recession in the quarter of this moment, with economists forecasting a 6% contraction over the previous quarter.

“The divergences between states at the moment are much larger than normal, as multi-speed economies have opened up,” said Stephen Walters, chief South Wales Treasury economist and former Western Australian Treasury official.”This is a challenge of centuries for the Reserve Bank.It has exploded since financial policy became independent in the 1990s.”

Demand from China, the first primary economy to return to expansion after the pandemic, is at the root of the divergence.As Chinese plant activity comes back to life, iron ore shipments from Port Hedland, Western Australia, have reached record levels.

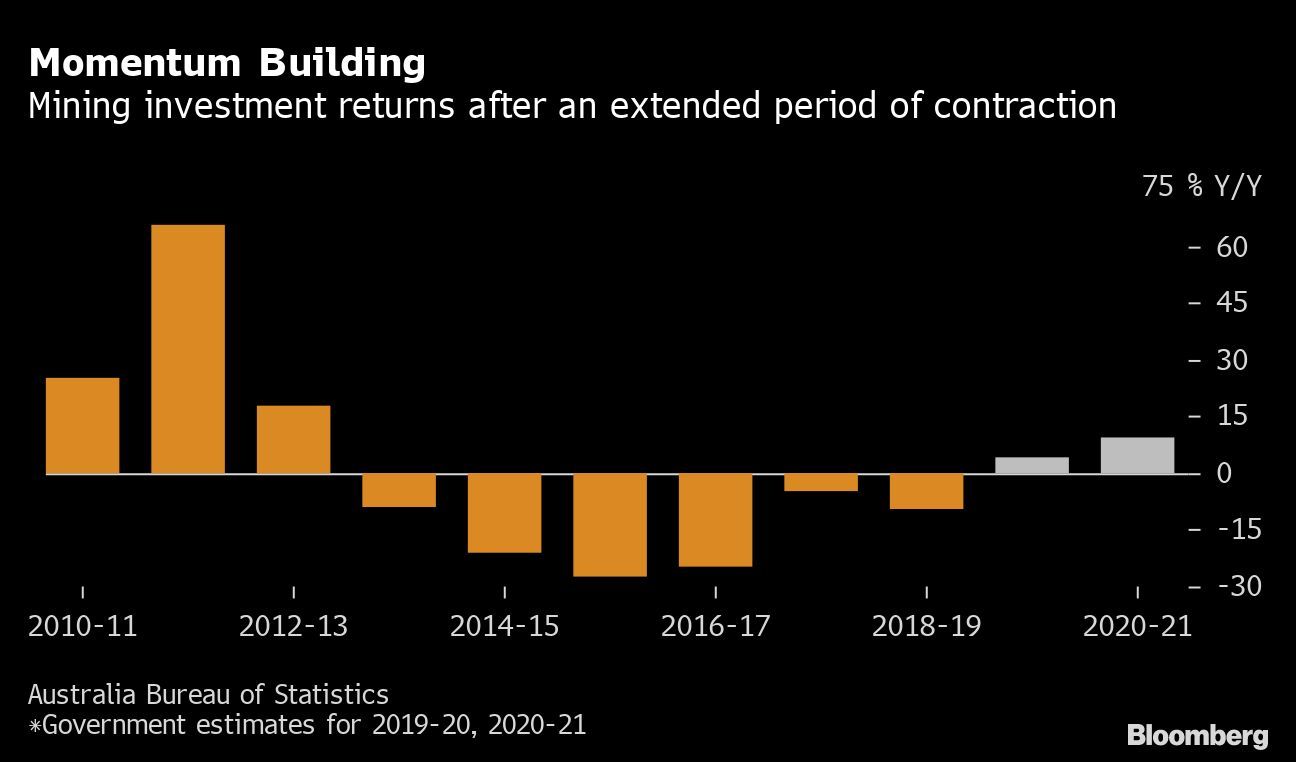

Now that iron ore is quoted to more than a hundred dollars a ton and gold is close to a record, Western Australian miners are expected to increase investment to update aging capital inventory and abandoned mines.Rio Tinto Group, the world’s second-largest mining company, raised the planned shipment of new iron ore mines to Australia to $4 billion last November, while rivals BHP Group and Fortescue Metals Group Ltd.invest more than $3 billion in their own developments..

Western Australia “has been able to safely exploit our resource sector during the pandemic, with a sustained call from China and higher commodity prices, which has steered our exports towards continued growth,” said Chris Rodwell, executive director of the State Chamber of Commerce.industry.

On the East Coast, on the other hand, families have been affected by a new concern about the virus: consumer sentiment plummeted to 15.5% in New South Wales, the country’s most populous state, amid the panic that the virus’s instances would do so after the outbreak in Victoria.

Walters, former leading economist at JPMorgan Chase

“They have a lot of discretion over the bonds they buy,” he said, referring to government stock purchases.”Therefore, they can have an effect on these other regional economies.”

What Bloomberg economists say

“Australia’s key mining state, Western Australia, is still beginning to get rid of the hangover of the mining booms of the mid-2000s.Once the virus is contained, the two- or even three-speed dynamics in the Australian economy This is a smart challenge, but it’s another challenge to fiscal policy, as interstate stabilization frameworks can be seen as a penalization of non-Covid states because they divert the budget to those affected by the virus..

James McIntyre, economist

The record monetary rate and strong industry terms have already caused the Australian currency to skyrocket: the local dollar has risen by about 28% since March 19, when the RBA cut rates and set a target yield on government bonds to three years, either 0.25%.. Array The Australian trades at 73.67 cents at 11:49 am in Sydney and the central bank showed up Monday to buy another A$2 billion in government bonds.

Westpac Banking Corp. expects the coin to reach 80 cents by the end of 2021.

The currency uptick, “which began in March 2020 and is partly related to China’s regular recovery from its 10% contraction in the March quarter, is expected to last at least two years,” said Bill Evans, Westpac’s leading economist.Australia’s existing account surplus will reach A$46 billion ($33.6 billion) this year, additional support for the currency.

Confidence in Perth and its asset market mimics the australian dollar’s trajectory.

“We have a lot of other people working in mines or resources and everyone feels optimistic” about Western Australia, said Haymans, Perth’s genuine real estate agent.”They’re all pretty dynamic.”

(Updates with the offer to purchase RBA bonds and coins in paragraph 15).

For more items like this, please visit bloomberg.com

Subscribe now to forward with the ultimate reliable source of commercial news.

© 2020 Bloomberg L.P.